#

Strategies

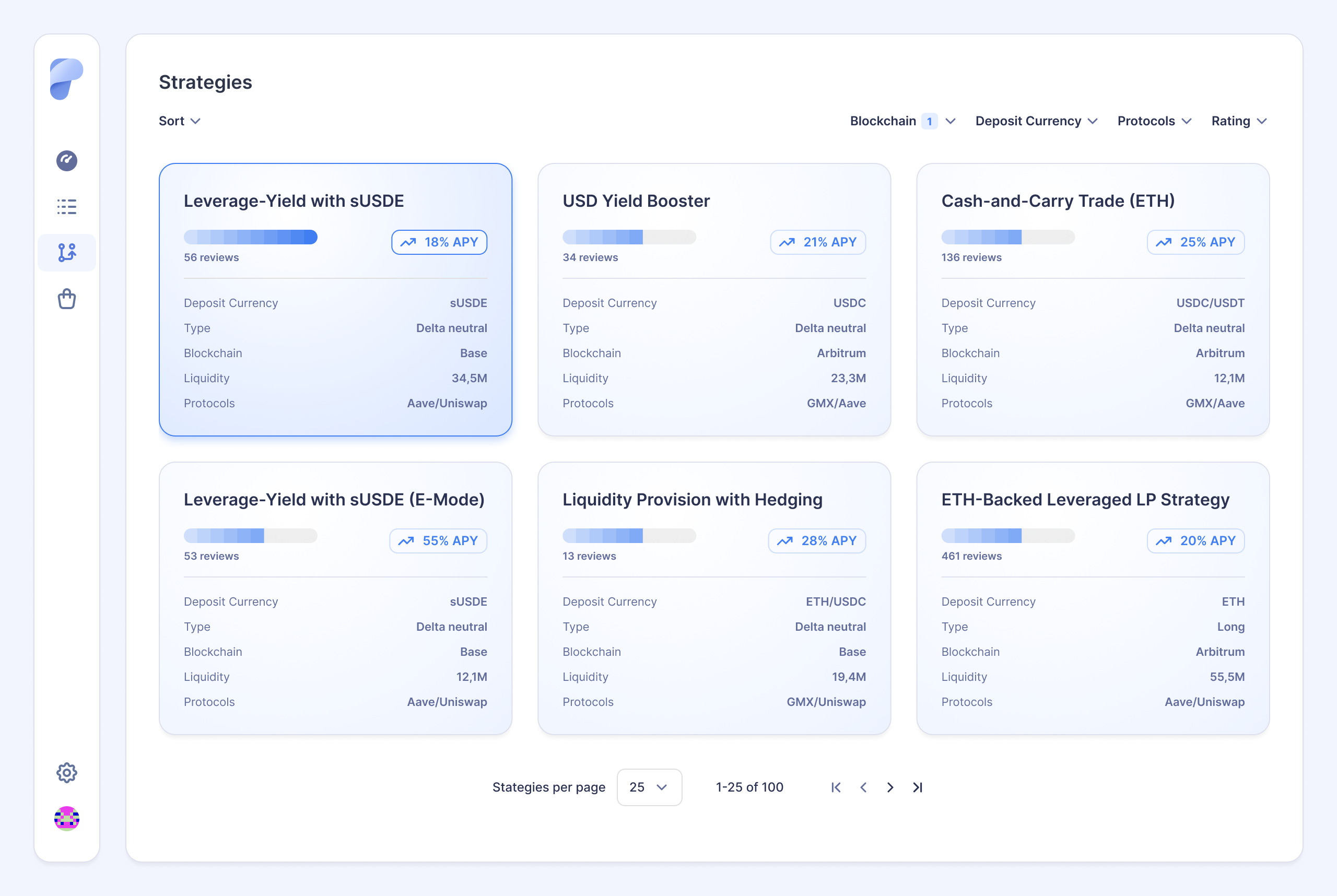

Pecunity Strategies are the core product of Pecunity and the primary use case of the platform.

They enable users to generate returns in the DeFi space. There are two ways to participate:

- Choose from a selection of pre-built strategies

- Create a custom strategy using the Strategy Builder via drag & drop

Created strategies can also be published by the community and made available to other users.

#

Types of Strategies

Users can choose from different strategy types, each with its own focus and return profile. Most strategies aim to generate yields and display an expected annual percentage yield (APY).

#

Long Strategy

- Invests “long” in one or more tokens

- Benefits from price increases in addition to generated yields

#

Short Strategy

- Invests “short” in one or more tokens

- Benefits from falling prices in addition to generated yields

#

Delta-Neutral Strategy

- Goal: Generate yields while minimizing exposure to price fluctuations of individual tokens

- Remains largely independent of overall market movements

#

Risk Levels

In addition to type, strategies differ in their risk profiles:

Low Risk

- Expected return: ~5–10%

- More conservative strategies

Medium Risk

- Expected return: up to ~20%

High Risk

- Expected return: above 20%

- Highly speculative, should be used with caution

#

Example Strategies Available at Launch

Additional strategies will be continuously made available, allowing users to select the ones that best match their risk profile and yield expectations across selected tokens.

#

Fee Model & $PEC Token

Each strategy execution incurs a fee, based on the transaction volume.

The utility token $PEC directly benefits from these fees:

- If fees are paid in tokens such as USDT or USDC, a portion is converted into $PEC and then burned.

- If fees are paid directly in $PEC, the fee is lower , but a small portion is still burned.

This ensures that with every strategy execution, the value and scarcity of $PEC are continuously supported in the long term.