#

ETH-Backed Leveraged LP Strategy

#

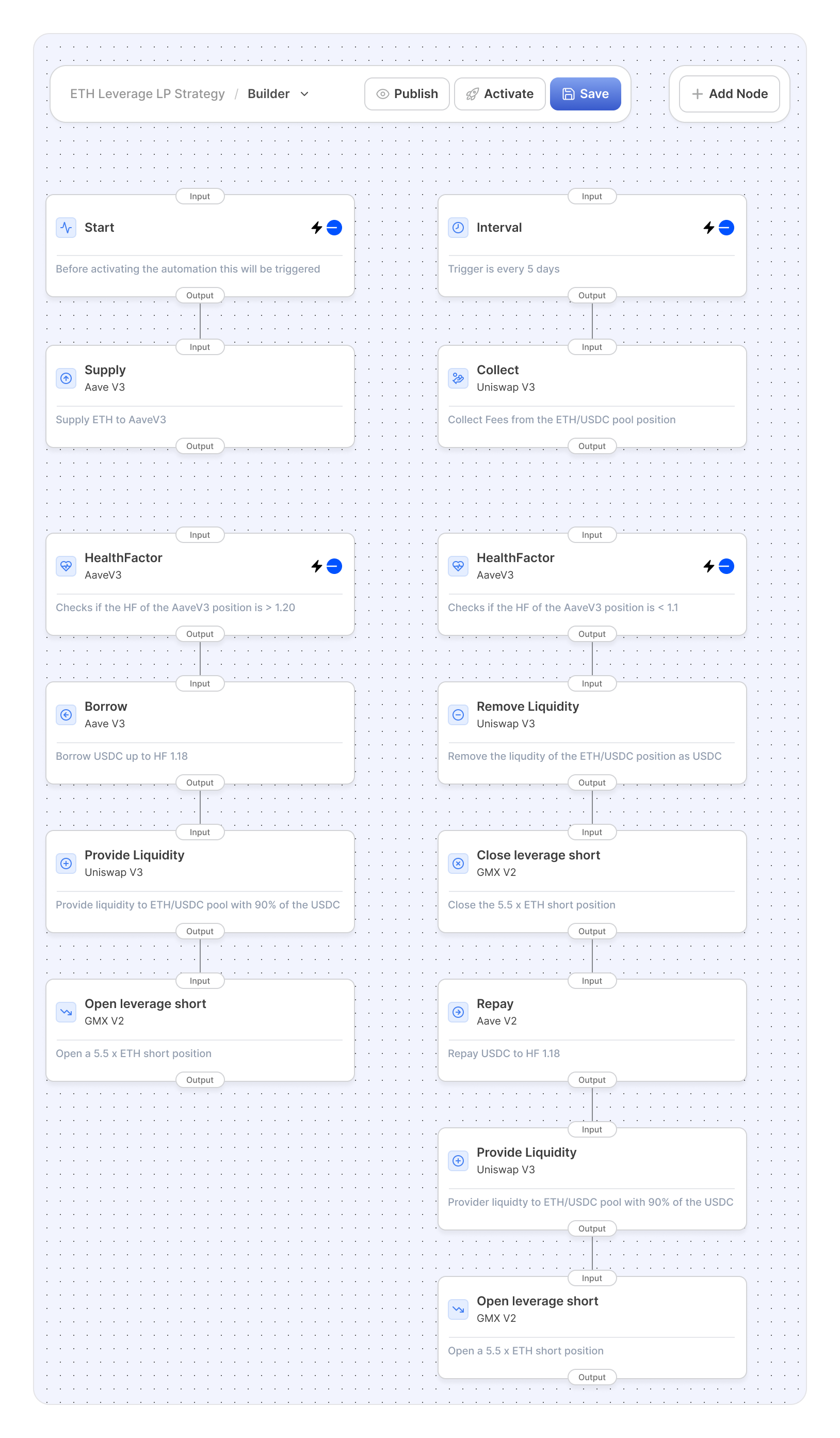

Introduction

This strategy leverages ETH as collateral on AaveV3 to borrow stablecoins (e.g., USDC), which are paired with ETH in a Uniswap V3 ETH/USDC liquidity pool using a concentrated price range (±15%). The impermanent loss (IL) exposure is hedged by opening and dynamically managing a short ETH perpetual position on a derivatives exchange. Advanced automation ensures continuous rebalancing of both LP exposure and short hedge for optimal performance.

- Collateral Token: ETH (supplied to AaveV3)

- Borrowed: Stablecoin (e.g., USDC at 70% LTV)

- LP Pool: Uniswap V3 ETH/USDC, 15% range around spot

- Hedge: Short ETH perp on a decentralized exchange (e.g., dYdX, Aevo, GMX)

- Automation: Auto-rebalance LP position and hedge, auto-compounding of LP fees

#

Strategy Workflow

- Deposit ETH as collateral on AaveV3.

- Borrow up to 80% of ETH value in a stablecoin.

- Provide both ETH and borrowed stablecoin as liquidity to the Uniswap V3 ETH/USDC pool, setting a narrow price range of ±15% around the current ETH/USDC price.

- Open a short ETH perpetual position (equal to total LP ETH exposure) to hedge against ETH price movements and mitigate impermanent loss.

- Continuously and automatically:

- Rebalance the Uniswap LP if price drifts outside the set range (concentrated liquidity management).

- Adjust the short position to precisely match the changing ETH exposure in the LP (hedge rebalancing).

- Compound LP fees periodically back into the strategy.

#

Automated Rebalancing Details

- LP Range Rebalancing: Automated bots or tools (Krystal, Orphic, Gelato) move LP positions if the ETH price exits the ±15% band, ensuring consistent fee earning.

- Hedge Recalibration: At each rebalance, the short position is updated to equal the notional ETH in the LP—whether that grows (due to trading) or shrinks (due to swaps or price drift).

- Compounding: Collected trading fees are automatically restaked into the LP position to boost yield.

#

Yield (APY) Calculation

#

APY Estimation (2025 conditions)

- LP fee APY: Providing concentrated liquidity within ±15% of spot increases fee capture dramatically (recent data: 18%–30% APY possible, depending on volatility and pool volume) .

- Borrowing Cost: At 70% LTV, borrowing USDC costs ~5.8% APY (Aave V3 average 2025) .

- Perp Funding Cost: Short hedge typically incurs ~14% APY in funding payments; may vary by exchange .

Net APY Formula:

\text{Net APY} = \text{Lending Fees} + \text{LP Fees} × 0.7 × 0.9 - \text{Aave Borrow Rate} × 0.7 + \text{Perp Funding Rate} × 0.7 × 0.1For example, 1,8\% + 58\% × 0.7 × 0.9 - 5.8\% × 0.7 + 14\% × 0.7 × 0.1 = 35.35\% APY. Periodic auto-compounding can boost effective yield to ~40% APY if reinvested efficiently.

#

Key Assumptions

- The LP remains in-range most of the time due to active rebalancing.

- Sufficient liquidity for shorting ETH on perps with low slippage.

- Aave V3 and Uniswap fee rates stay consistent with summer/fall 2025 averages.

- Auto-compounding and rebalancing efficiency do not incur excessive gas or protocol costs.

#

Risks

- Liquidation Risk: At 70% LTV, a small drop in ETH price can lead to collateral liquidation.

- Concentration/Volatility: Narrow LP ranges can lead to capital being sidelined ("out of range") if ETH/USD experiences sharp moves.

- Imperfect Hedge: LP and hedge exposures may diverge under certain market conditions or slippage, causing tracking error.

- Funding Rate Swings: If short perp funding spikes, strategy net yield can drop sharply.

- Automation Failure: Automated bots for rebalancing/hedging must be reliable to prevent unhedged exposure or missed fee opportunities.

#

Summary

This strategy uses an aggressive 70% ETH LTV to maximize LP capital efficiency in a ±15% Uniswap V3 ETH/USDC range, while employing dynamic short hedging to neutralize price risk. With proactive management, APYs of 35-40% (occasionally higher) are feasible in 2025, provided volatility and trading volume remain strong and automation is robust.

Sources: Uniswap V3 and DeFi fee analytics, Galaxy Onchain Yield Reports, Aave V3 Borrow Rate Statistics, Perp DEX funding data (Q3 2025)